Personal Currency Exchange, Simplified.

Secure and competitive exchange rates for your international needs.

Tailored FX Solutions for Your Personal Needs

We understand that your personal finances are just as important as your business transactions. Whether you’re buying a property abroad, sending money to loved ones overseas, or simply managing your international finances, our dedicated account managers are here to help. We offer competitive rates, fast remittance, and personalized guidance to ensure your money moves smoothly and securely.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

- No hidden costs or fees.

- Award-winning 24/7 online platform.

Making Your International Transactions Easy

Buying Overseas

Dreaming of a vacation home in Spain, a vintage car from Germany, or an investment property in Dubai? We’ll help you secure competitive exchange rates for any overseas purchase, big or small. Our team can monitor the market and provide expert guidance, ensuring you get the most out of your money and time your transaction perfectly.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

Moving Abroad

Moving abroad is a big step. Let us handle the complexities of currency exchange, so you can focus on settling into your new life. Your dedicated account manager will provide personalized guidance, monitor the market, and keep you informed of any fluctuations that may impact your finances.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

One-Off Payments

Need to make a one-time international payment? Whether it’s for a family gift, tuition fees, or a charitable donation, we offer competitive rates and a transparent fee structure. No matter the amount, we’ll ensure your money reaches its destination quickly and securely.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

Receiving Funds from Abroad

Whether you’re selling a property overseas, receiving an inheritance, or repatriating funds, we make it easy to bring your money back to the UK. Our streamlined process ensures a hassle-free experience, with no hidden fees or unexpected charges.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

One platform for all your international transactions - Access Anytime, Anywhere.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

- No hidden costs or fees.

- Award-winning 24/7 online platform.

Tailored Services for Your Needs

Our team of experienced FX specialists are here to help guide you stay one step ahead. We provide personalised solutions and support with insight to help you navigate the complexities of the global currency market so you can focus on your Business.

Spot

Transfer

Need to make a payment now? Secure competitive exchange rates and send or receive funds internationally with fast, secure Spot Transfers.

0% Forward

Contract

Protect your business from currency fluctuations. Lock in today's rates for future transactions with Forward Contracts.

Market / Limit

Order

Execute trades automatically at your desired price or market rate with Market and Limit Orders, providing flexibility and control.

Multi-Currency

Account

Hold and manage multiple currencies in one convenient account, simplifying international transactions and reducing fees.

Bulk

Payments

Our mass payments technology makes it easy to manage those bulky time consuming transactions so businesses can stay focused on their key objectives.

Trade

Finance

Expand your business with Trade Finance and Invoice Finance solutions that offer credit to fund your payables.

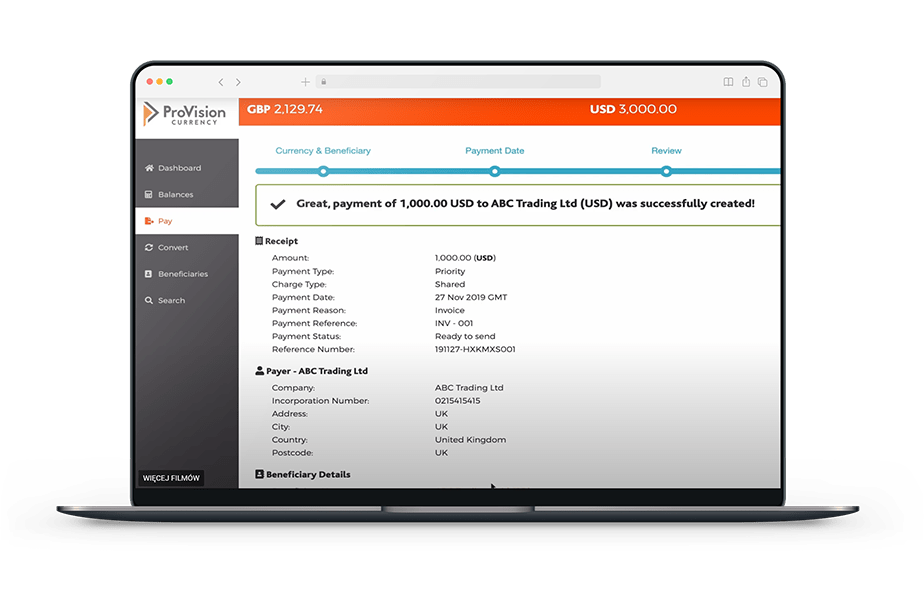

Online Platform

Access our Award Winning 24/7 platform to manage your FX transactions, monitor rates, and stay informed about market trends. Use on your desktop (Mac or PC), tablet or smart phone.

Our team of experienced FX specialists are here to guide you through every step of the process, from choosing the right solution to managing your transactions. We provide personalized support and insights to help you navigate the complexities of the global currency market.

We’re more than just money transfers.

At Provision Currency, we're more than just a foreign exchange provider. We're your strategic partner, dedicated to making global transactions simple, secure, and successful. Our partnership with a world-leading technology platform allows us to offer competitive, bank-beating exchange rates and lightning-fast remittance services, ensuring your money moves efficiently across borders.

We understand that every client is unique. That's why we offer tailored services for businesses of all sizes, from large corporations to ambitious SMEs, as well as private individuals with diverse financial needs. Our team of experienced account managers are always on hand to provide expert knowledge and support, ensuring you have the tools and knowledge to navigate the complexities of the global currency market.

Data

Protection

ProVision Currency Ltd is registered with the UK Data Protection Act.

ProVision Currency Lts is registered with the ICO under registration ref: ZB352748

Client’s personal data shall be obtained only for specified and lawful purposes.

Safeguarding Client Accounts

Funds are safeguarded by our FCA-regulated e-money partners at a credit institutions. The client accounts are ring-fenced from the company’s funds, and therefore protected from the unlikely event of any financial difficulties within the company. Clients money always stay separate to any of our liquidity.

Safeguarded Bank Accounts

The Client’s accounts are ring fenced from the company’s funds so your money remains protected at all times. Our partners stop safeguarding your funds once the money has been paid out.

Data

Security

Certified under ISO/IEC 27001:2013, the international best practice standard for information security management. Registered with FinCen in the United States and authorised in 22 states to transmit money

Need Help?

Find Answers Here

We’re here to help! Browse our FAQ section for answers to common questions about our services, fees, and security measures. If you need further assistance, don’t hesitate to reach out – our team is always happy to help.

How can Provision Currency help me save money on my international money transfers?

We offer competitive exchange rates that often beat those offered by traditional banks, helping you save money on every transaction. Additionally, we have no hidden fees or charges, ensuring transparency and cost-effectiveness.

What kind of personalised support can I expect as a private client?

You’ll have your own dedicated FX Account Manager who will provide expert knowledge and tailored solutions based on your unique financial needs. They’ll be available to assist you every step of the way, whether you’re buying a property abroad, sending money to loved ones, or managing your international finances.

Is my money safe with Provision Currency?

Absolutely. Funds are safeguarded by our FCA-regulated e-money partners at a credit institution, ensuring they’re protected and separate from our company’s finances. We also adhere to strict regulatory requirements and employ industry-leading security measures to safeguard your transactions and personal information.

Can I use Provision Currency's services if I'm moving abroad?

Yes, we specialize in helping individuals navigate the complexities of currency exchange when moving abroad. Your dedicated Account Manager will guide you through the process, monitor exchange rates, and help you make informed decisions to ensure a smooth transition.

What's the difference between a bank and a currency exchange specialist?

Banks typically offer less competitive exchange rates and may have higher fees compared to specialist FX providers like Provision Currency. We focus exclusively on foreign exchange, providing expertise, personalized service, and better value for your money.

How can I avoid high fees when sending money abroad?

Choose a provider that offers transparent pricing with no hidden fees. At Provision Currency, we’re upfront about our costs, ensuring you know exactly what you’re paying for and can make informed decisions.

What's the fastest way to send money internationally?

We offer same-day remittance for major currencies like GBP, EUR, and USD, ensuring your funds reach their destination quickly and efficiently.

Is it better to exchange currency before or after traveling abroad?

It depends on your individual circumstances and preferences. We can help you weigh the pros and cons of each option and choose the best strategy based on your travel plans and current exchange rates.

What is the foreign exchange market?

The foreign exchange market, also known as the FX or forex market, is a global decentralized market where currencies are traded.

How are exchange rates determined?

Exchange rates are determined by supply and demand in the market. Factors like economic conditions, interest rates, political events, and market sentiment all play a role in influencing exchange rates.

What is a currency conversion fee?

A currency conversion fee is a charge levied by banks or other financial institutions for converting one currency to another.

What is the best way to track exchange rates?

You can track exchange rates through various online tools and financial news sources. Our online platform provides real-time rate information, and your dedicated Account Manager can keep you updated on market trends.