Corporate Currency Exchange, Simplified.

Expert Guidance, Competitive Rates, No Hidden Fees.

- Your Dedicated FX Account Manager

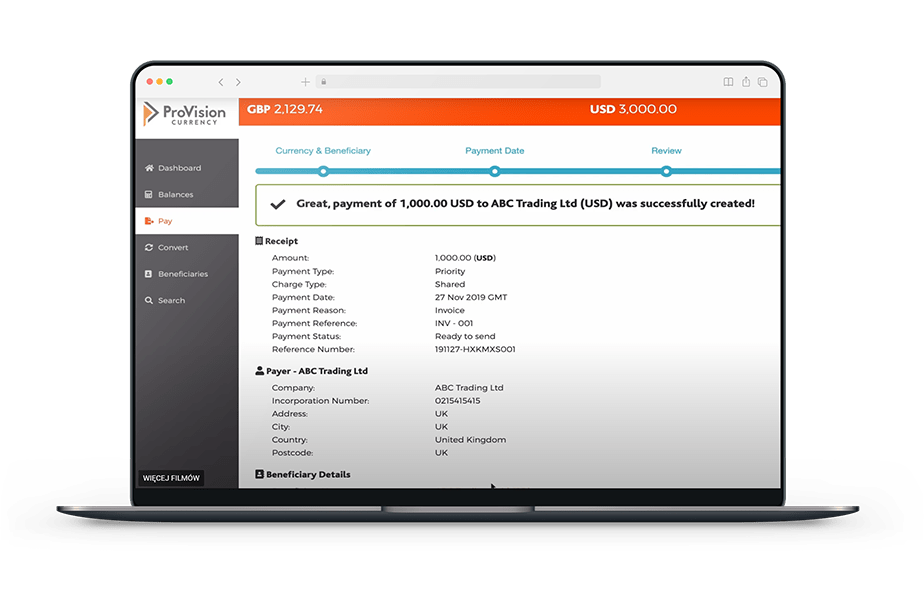

- Award-Winning 24/7 Online Platform

- Multi-Currency Accounts for Seamless Transactions

Your Dedicated Partner for Global Success

At Provision Currency, we believe in building lasting relationships with our clients. That’s why we assign a dedicated FX account manager to every business, providing personalized guidance and support throughout your international transactions.

We understand that navigating the complexities of the global marketplace can be daunting. Our aim is to simplify the process, offering you a seamless experience and expert advice every step of the way.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

- No hidden costs or fees.

- Award-winning 24/7 online platform.

Solutions for every business

Sole Traders & SMEs

We know you’re juggling multiple responsibilities. That’s why we offer simple and efficient FX solutions to save you time and money. Benefit from competitive exchange rates and a dedicated account manager to guide you through every step.

Growing Businesses

As your business expands globally, you need a reliable partner for international payments. Our platform provides secure, cost-effective solutions for paying overseas suppliers and employees, with access to 130+ currencies in 190+ countries.

Large Corporations

Managing complex FX exposures requires expertise and tailored solutions. Our experienced team will work closely with you to develop strategies that mitigate risk and optimize your international cash flow.

Travel companies

Many tour and travel operators unknowingly lose thousands due to hidden currency transfer fees and struggle to receive funds efficiently. With our platform, you can receive payments from customers worldwide directly into your named currency account, store the funds securely, and then either send them out in the same currency or convert them to the currency needed to pay your suppliers.

Import and Export

Unfavourable currency exchange fluctuations can build up, posing unnecessary challenges for finance departments and limiting your business’s growth potential. If your business needs to purchase €300,000, transferring funds at £1.30 per Euro instead of £1.27 per Euro could save you £5,451.24. Thanks to our strong partnerships with payment providers, we ensure you receive better-than-bank exchange rates.

Sport

Sports organizations rely on our payments network for international money transfers. Whether you’re acquiring a foreign player or importing merchandise, we manage the currency so you can focus on managing the players. Our platform enables CFOs and management to log in 24/7 and make transfers with ease.

Retail

Whether you’re paying suppliers in China or Europe or , our live platform is straightforward and free to use. You can manage all your payments in one place.

One platform for all your international transactions - Access Anytime, Anywhere.

- Competitive, bank-beating exchange rates.

- Your own dedicated FX Account Manager.

- Multi-Currency Account.

- No hidden costs or fees.

- Award-winning 24/7 online platform.

Tailored Services for Your Needs

Our team of experienced FX specialists are here to help guide you stay one step ahead. We provide personalised solutions and support with insight to help you navigate the complexities of the global currency market so you can focus on your Business.

Spot

Transfer

Need to make a payment now? Secure competitive exchange rates and send or receive funds internationally with fast, secure Spot Transfers.

0% Forward

Contract

Protect your business from currency fluctuations. Lock in today's rates for future transactions with Forward Contracts.

Market / Limit

Order

Execute trades automatically at your desired price or market rate with Market and Limit Orders, providing flexibility and control.

Multi-Currency

Account

Hold and manage multiple currencies in one convenient account, simplifying international transactions and reducing fees.

Bulk

Payments

Our mass payments technology makes it easy to manage those bulky time consuming transactions so businesses can stay focused on their key objectives.

Trade

Finance

Expand your business with Trade Finance and Invoice Finance solutions that offer credit to fund your payables.

Online Platform

Access our Award Winning 24/7 platform to manage your FX transactions, monitor rates, and stay informed about market trends. Use on your desktop (Mac or PC), tablet or smart phone.

Our team of experienced FX specialists are here to guide you through every step of the process, from choosing the right solution to managing your transactions. We provide personalized support and insights to help you navigate the complexities of the global currency market.

We’re more than just money transfers.

At Provision Currency, we're more than just a foreign exchange provider. We're your strategic partner, dedicated to making global transactions simple, secure, and successful. Our partnership with a world-leading technology platform allows us to offer competitive, bank-beating exchange rates and lightning-fast remittance services, ensuring your money moves efficiently across borders.

We understand that every client is unique. That's why we offer tailored services for businesses of all sizes, from large corporations to ambitious SMEs, as well as private individuals with diverse financial needs. Our team of experienced account managers are always on hand to provide expert knowledge and support, ensuring you have the tools and knowledge to navigate the complexities of the global currency market.

Data

Protection

ProVision Currency Ltd is registered with the UK Data Protection Act.

ProVision Currency Lts is registered with the ICO under registration ref: ZB352748

Client’s personal data shall be obtained only for specified and lawful purposes.

Safeguarding Client Accounts

Funds are safeguarded by our FCA-regulated e-money partners at a credit institutions. The client accounts are ring-fenced from the company’s funds, and therefore protected from the unlikely event of any financial difficulties within the company. Clients money always stay separate to any of our liquidity.

Safeguarded Bank Accounts

The Client’s accounts are ring fenced from the company’s funds so your money remains protected at all times. Our partners stop safeguarding your funds once the money has been paid out.

Data

Security

Certified under ISO/IEC 27001:2013, the international best practice standard for information security management. Registered with FinCen in the United States and authorised in 22 states to transmit money

Need Help? Find Answers Here

We’re here to help! Browse our FAQ section for answers to common questions about our services, fees, and security measures. If you need further assistance, don’t hesitate to reach out – our team is always happy to help.

How can Provision Currency help my business manage FX risk?

Our team of FX specialists will work closely with you to develop tailored hedging strategies, using tools like Forward Contracts and Market/Limit Orders, to mitigate the impact of currency fluctuations on your business.

What industries does Provision Currency specialize in supporting with FX solutions?

We cater to a diverse range of industries, including travel, import/export, sports, and retail. Our expertise allows us to understand the unique challenges and opportunities each sector faces in the global marketplace.

How can I access Provision Currency's online platform?

Once you open a corporate account with us, you’ll gain access to our award-winning online platform. You can log in anytime, anywhere, to manage your transactions, track rates, and access valuable market insights.

Does Provision Currency offer any additional services beyond FX?

Yes, we also offer Bulk Payments and Trade Finance solutions to streamline your international transactions and support your business growth.

How can I reduce the cost of international payments for my business?

By choosing a specialist FX provider like Provision Currency, you can access competitive exchange rates and avoid excessive bank fees. Our transparent pricing ensures you know exactly what you’re paying for.

What is the best way to protect my business from currency fluctuations?

Forward contracts are an effective way to lock in today’s exchange rates for future transactions, shielding your business from potential losses due to adverse currency movements.

How can I make international payments more efficient for my business?

Look for a provider with competitive rates, transparent fees, a user-friendly platform, and excellent customer support. It’s also essential to choose a provider with expertise in your industry and a proven track record of success.

What is the difference between a spot transaction and a forward contract?

A spot transaction involves buying or selling currency at the current market rate for immediate delivery. A forward contract allows you to lock in today’s rate for a future transaction, protecting you from potential currency fluctuations.

What are the main factors that affect exchange rates?

Exchange rates are influenced by various factors, including economic indicators, interest rates, political events, and market sentiment.

What are the benefits of using a multi-currency account?

A multi-currency account allows you to hold and manage multiple currencies in one place, simplifying international transactions and reducing conversion fees.

How can I ensure the security of my international payments?

Choose a reputable FX provider that adheres to strict regulatory requirements and employs robust security measures, such as segregated client accounts, data encryption, and fraud prevention protocols.